Online Payments: how to work with & around those annoying fees

Table of Contents Show

Today I want to help set ya straight on payment processing fees.

I know, I know. It’s not a sexy topic. But hear me out!

I see and read and hear complaints about this all the time. So let’s walk through it in a way that makes sense.

You’ll learn why there are fees, what a standard fee looks like & where they’ll hide, how to work with them, who I trust (& who I don’t), and what you can/can’t do to work around them in your business.

Why do payment processing fees exist?

This one’s easy…. 🥁

These companies have fees because they are providing a service, and that’s how they make their money.

I know it might seem obvious, but I guess it isn’t because your response to that might’ve been, “…Oh. Well, …I guess that' makes sense.”

And if your response was “Well duh–” then just move on to the next section, because this one isn’t written for you anyway!

Let’s take PayPal for instance.

Their service is free, as far as I know. Both my husband and I have a PayPal account with a card attached to it. Not only is that account free and the cards attached to it too, but we also get cash back rewards when we use the cards. These aren’t credit cards either; they’re just a debit card hooked up to the PayPal account. So they are literally giving money back to me, only because I used their debit card to spend money.

So, if the service is free, the cards are free, the account is free, AND they’re giving money BACK TO ME… then how do they make their money? Processing payments, of course!

They’re not charging me to buy something, but they are charging the shop owner/service provider I’m paying, –ALWAYS.

Payment processing info

They make money when customers use their payment system to process incoming vendor payments, by taking a small percentage of the transaction in return, which is usually around 2.9% + .30 cents. We can just call it a 3% fee, basically.

That seems to be true for most processors. They are all around 3% per transaction; if your payment processor takes more than that you need to switch, because it’s higher than the competition and unless they offer some crazy extra features for that higher price point, you're overpaying in fees.

What does it mean to process a payment?

Payment processing means basically calling the customer’s bank to check if the funds are there, then calling the shop owner/service provider’s bank & saying the funds are definitely there. Then helping both banks talk to each other to move that amount from one to the other –all in 2-3 business days, on average.

Of course, this is all done without real phone calls to banks, etc. and is likely all automated by computers, BUT that’s what they’re doing and that’s why they charge to do it.

It also has to be a secure service for most customers to want to use them (because, ya know, they’re handling our money & have access to where we put it). Since PayPal is a secure service, they can charge a fee for what they do.

Where do these fees hide?

Everywhere.

Just kidding! They do tend to hide in places where you might not be expecting them.

For example:

If you have a shop on the Business plan of Squarespace, Squarespace takes their own processing fee (3%) in addition to the processor’s fee (also about 3%), for a total of 6% per transaction. WHOA.

But if you upgrade your Squarespace plan to the Basic Commerce plan, that extra 3% transaction from Squarespace goes away, leaving you with just a 3% per transaction fee from either PayPal or Stripe (or Square if you sell in-person products too).

Now, it's worth saying here that if you aren't selling enough per year to make up the difference in the plan change on Squarespace, then just factor in the extra 6% to cover the fees until you're ready to upgrade the Squarespace plan. (Keep reading for a formula to figure out how to do this, exactly!)

Another example is:

▪️ Memberspace. You can sell products & memberships using their platform that offer flat or tiered pricing, recurring payments for members, etc. But if you don’t read closely, they charge their own 4% processing fee, on top of whatever payment processor they use (Stripe, I think), for a total of 7% per transaction. YIKES!

Now Memberspace will begin to cut their 4% fee down as your sales grow & you upgrade your plan with them, much like Squarespace.

▪️ Speaking of Squarespace, they now have Member Areas! Hooray! But each tier of their Member Areas plans have an additional transaction fee percentage, starting at 10% I believe, and going down as you upgrade to a higher Member Areas plan.

Make sure you read the fine print. They’ll tell you what the fees are, and if they don’t, –just ask!

How do I price my services with those fees?

Easy. Build that into your pricing. Account for it!

If you know you want to charge $100 for a 30-minute coaching session, and you actually charge the client $100, know that you will only get 97% of that payment.

Yes, that does mean you will have to charge about $103 to actually get the $100, which may be a weird number to invoice for, so adjust it & find what works best for you.

Your pricing needs to reflect the worth & value of the service or product you are selling AND any expenses you use in order to generate it or keep helping people with your service/product.

So, let’s go back to the Memberspace example.

If your Memberspace plan is $25/mo, and they take a 7% total fee off the top of every payment made through their system on that plan, then you need to add maybe 7-10% to your pricetag to help cover your business expense in offering the service/product.

Now, I’m not necessarily saying that if you pay for Planoly + Artful Agenda + Squarespace + G-Suite + Adobe CC 2020 + RightFont + Asana… (you see where I’m going with this?)… that you have to incorporate a percentage of each of those things into packages.

BUT, make sure you take those things into account. If you don’t know how much your business expenses are, whether each month or each year, your business isn’t as likely to maintain a profit and therefore… keep running in order to serve your customers/clients. Right?

One more time, for the people in the back:

If you are charging a client $100 for something, but your expenses to make that product cost you $90, and the fee to receive that cost you another $3, then you aren’t making any money.

Is there a way around that 3% fee?

You have a couple different options here.

You can switch to analog payments; that is, cash or check only.

You can switch to using mostly ACH (bank transfer) payments.

You’ll need Stripe for ACH payments; I don’t believe PayPal or Square handles those. But the cool thing is that their fee is less than 1% per transaction and it’s capped at $5, total. That means any payment over $625 only collects a $5 fee to process that payment.

Let’s put that into perspective, shall we?

Let’s say you are billing a very large project for $10,000. If the client pays via credit card your 3% fee will be about $300, versus $5 if the client pays via an ACH bank payment.

If you have Dubsado* like I do, you can choose whether to only accept ACH payments in your ‘Receive Money’ settings, or whether you want to accept both credit card & ACH payments. Just uncheck the method you want to stop accepting for now. (Don’t worry, that’s not a permanent choice! You can change your mind as needed.)

If you choose to switch over to ACH only, you can override that setting per invoice, in the project’s invoices area.

To do an override, you go to:

The client’s project inside your Dubsado account

Click the Invoice tab

Click the ‘Invoice Options’ link inside the Invoices area, and check the additional payment method you want to offer that client

Then Save

Now that client can pay with an additional payment method, but the ACH is still your default.

Which payment processors do I trust?

Last year I would’ve said PayPal, Stripe and Square.

Now? I’d say they ALL have pros & cons.

Here’s what I know about each:

PAYPAL

secure

fee: 2.9% + .30¢

free to use most of their features

can have your own account linked to a card

easy transfers to your bank

free in 2-3 days, or

immediate for a percentage of the transfer amount

Versatile: available to use with pretty much anything, everywhere

has their own card reader so you can take in-person payments with strip or chip cards

tends to favor the buyer over the seller in disputes

this causes issues for service-based businesses who are forced to issue a refund when a buyer isn’t happy with the end results, even though services were rendered. If the buyer files a dispute claim, PayPal is much more likely to side with our client, even though we have an ironclad contract proving our case. Something to think about!

STRIPE

“secure” – I say this in quotes, because they are supposed to be…

…but I do know someone personally whose Stripe account got hacked & it was very difficult for her to

A) retrieve the money lost (it was refunded en masse for products that had already shipped & been delivered to happy customers)

B) deal with their awful support team. It took them forever to admit what the problem was, and even when they did admit it, they didn’t want to help her get the money back. They told her to invoice those people a 2nd time and hope they pay again, because by that point the refund had gone through & there was nothing they could do about it. 🙄

credit card fee: 2.9% + .30¢

ACH fee: 0.8% (capped at $5 per transaction)

free to use most of their features

easy transfers to your bank

usually within 2-3 business days for most accounts

new accounts can take longer

Versatile: available to use with pretty much anything, everywhere

has their own card reader so you can take in-person payments with strip or chip cards

SQUARE

secure

fees vary:

2.6% + .10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards (in-person sales)

3.5% + 15¢ for manually keyed-in, processed using a ‘Card on File’ or manually entered using ‘Virtual Terminal’

2.9% + 30¢ OR 3.5% + 15¢ for invoices processed using ‘Card on File’

free to use most of their features

easy transfers to your bank

usually within 2-3 business days for most accounts

new accounts can take longer

Not quite as versatile. Squarespace, for example, only integrates with it for in-person sales at this time, not online shop sales (at time of posting)

has their own card reader so you can take in-person payments with strip or chip cards

has their own Point of Sale system, including a actual hardware like scanners, stands, docks and more

What you can/can’t legally do with those fees

First of all, let me start by saying, I’m not an attorney or a finance expert & this is not considered offiial advice for anyone specific. Please do your own due diligence wherever you live.

That being said, it’s common knowledge in the online space that you cannot (in most places) include your processing fee as a line item when you bill your client.

That means, it’s okay to generally increase your pricing to help cover your own expenses, but you can’t literally just pass it on to the client.

Here’s the difference:

Example 1:

$2,000 Pricing bumped up 3% to help cover the fees; the client only ever sees this amount:

– $2,060.04 for 4-5 page website design. (That’s the only price on the invoice.)

Example 2:

$2,000 Pricing line-itemed to cover the fees; the client only ever sees these amounts:

– $2,000 for 4-5 page website design

– $60.04 credit card ‘convenience fee’

Total: $2,060.04

See the difference?

In the first one, you know you’re charging $2,000 + the fees to cover the cost of allowing the client to use a card + any other expenses related to completing the project, except you never bill them for just the $2,000 alone, unless your actual plan was to only make $1,941.70.

Instead, when you send the proposal right from the beginning, you put the full $2,060.04 amount there so the client is never surprised; they know what to expect & everyone is happy!

In the second one, everyone knows what you’re doing & the client will be (understandably) annoyed that you’re passing off an expense of being a business owner, onto them. It may even be illegal to do this in your area, because it actually is in a lot of places. If it isn’t illegal where you are, just avoid doing this anyway; you don’t wanna look like a penny-pincher to all your clients.

I know that doesn’t seem like a huge difference, but it is. Think about it!

How many times have you picked up your dog from the vet, or gone into a store to pay for something and been shocked when the total is higher than the price you expected? That’s when you see the sign on the counter that says something like “3% convenience fee for using credit cards.”

Great. 🙄

Especially in the online world, where they often feel (understandably) that making an online payment in some form is the only option, so the 3% add-on fee becomes especially annoying for our clients if they A) didn’t know about it beforehand, and B) feel they have no other choice.

Don’t make your clients feel like that!

Don't make it harder for clients to pay you!

I see some people deciding to work around fees the legal way: by not taking online payments. That means only accepting checks or accepting unusual types of payments like Venmo or PayPal friends & family, –or whatever.

Don’t use alternative forms of online payment. Just don’t. It can make the customer feel iffy, suspicious & weird or uncomfortable. I’d personally feel VERY uncomfortable paying someone via Zelle/Venmo/Bitcoin/PayPal F&F for a professional service… It’s just not professional, seems kinda skeevy and it’d make me want to back out of ‘the sale,’ so to speak. Plus I don’t have a Venmo or Bitcoin account anyway and wouldn’t want to create one just to pay a contractor.

If however, you really want to ONLY accept cash or check payments, then go right ahead! Maybe it'll work well for you. I haven’t gotten paid via check in years, and none of my clients have requested that either.

Regardless, my gut feeling says DON'T make it harder for your clients to pay their invoices.

Plus, how much faster will you get a payment if you send an invoice your customer can pay online, right when they get it?

Versus waiting for them to write the check, which may have to be handled by a certain type of person in their office, then wait for the mail to arrive, then deposit it & wait for that check to clear.

That could easily take a week or two which feels like a long time, especially if that payment needs to be in-hand before further services can be rendered, not to mention that 1-2 week timeframe could be even longer if they don’t pay the bill the day the invoice arrives OR if the client doesn’t live in your country.

If the thought of chasing down your customers to pay their bills on time is 100% icky for you, then please don't add more struggle to the process. (Also, if that’s you, please start using a CRM like Dubsado so it can automate this process for you.)

bonus!

How to calculate what your fees will be & price accordingly

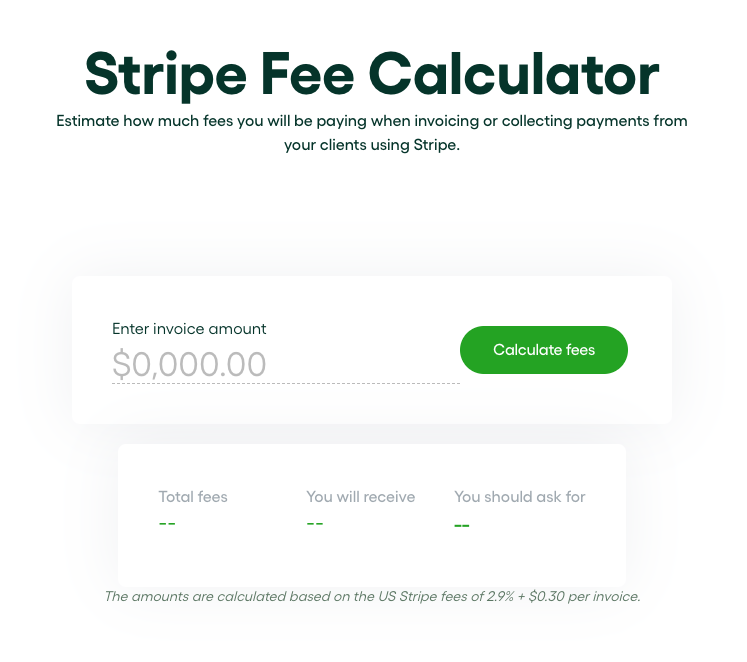

There are quite a few calculators for these kinds of fees out there on the interwebs, but this one is simple & seems the most useful for me + it’s totally free to use.

Here’s the link to Bonsai’s (free) Stripe Fee Calculator* (shown below) &/or to my Pricing Calculator Template in the shop.

As you can see, you enter a price you want to charge, whether that’s $50 or $2,000 and it will tell you how much the fees will be, what you will receive, and then what you should ask for instead, in order to get the amount you entered originally.

If you don’t actually hate math (I do! 🙋🏻♀️), you can voluntarily work out your own equations using this helpful formula below. (Psshh, ––like you even need me to tell you… but I will anyway!)

X ➗ (1 – Y)

X = the amount you want to receive

Y is the percentage of fees in a decimal point value

For all of you who are not math nerds, I’m sure you’ll be wanting an example of how to plug something into that.

Am I right? Only me, again? 🙋🏻♀️ 😂

.029 is the 2.9%

1 – .029 = .971

2000 ➗ .971 = $2,059.73 (what you charge)

$2,059.73 ✖️.029 = $59.73 (fees paid to PayPal)

my preference

I use Stripe for product or course sales or Quickbooks Payments for all of my 1:1 billed services in my business. Using Quickbooks Online with Dubsado can be tricky but their processing works a bit differently than Stripe and it’s just different enough to warrant the extra work that using both together requires. Learn more about how I use Dubsado with Quickbooks.

Using PayPal for business transactions with my custom clients makes me a little nervous because PP tends to side with the buyer & that really sucks for service-based businesses because services have been rendered at the time of payment. In theory, this nightmare scenario should never happen, since my goal is ALWAYS to make sure my clients are actually happy with the product before we launch it. I also have a good contract that protects me, of course, & I always get final approval in writing somehow to back me up IF needed, though I never have.

I take those extra precautions just in case the client decides AFTER approval that they don’t like the product & want a refund, even though services have been rendered, the site is live & being used, etc… At least I’d have written proof for the approval & that we ended the working relationship on good terms. I just hope, as everyone does, that it never comes to this.

I don’t use Square much at all, but I do have an account with them from a few years ago when I got their mag-stripe card reader for taking in-person payments. It doesn’t connect to as many of the services I use, so I don’t really use it because of that.